Things to consider when getting a personal loan

Introduction

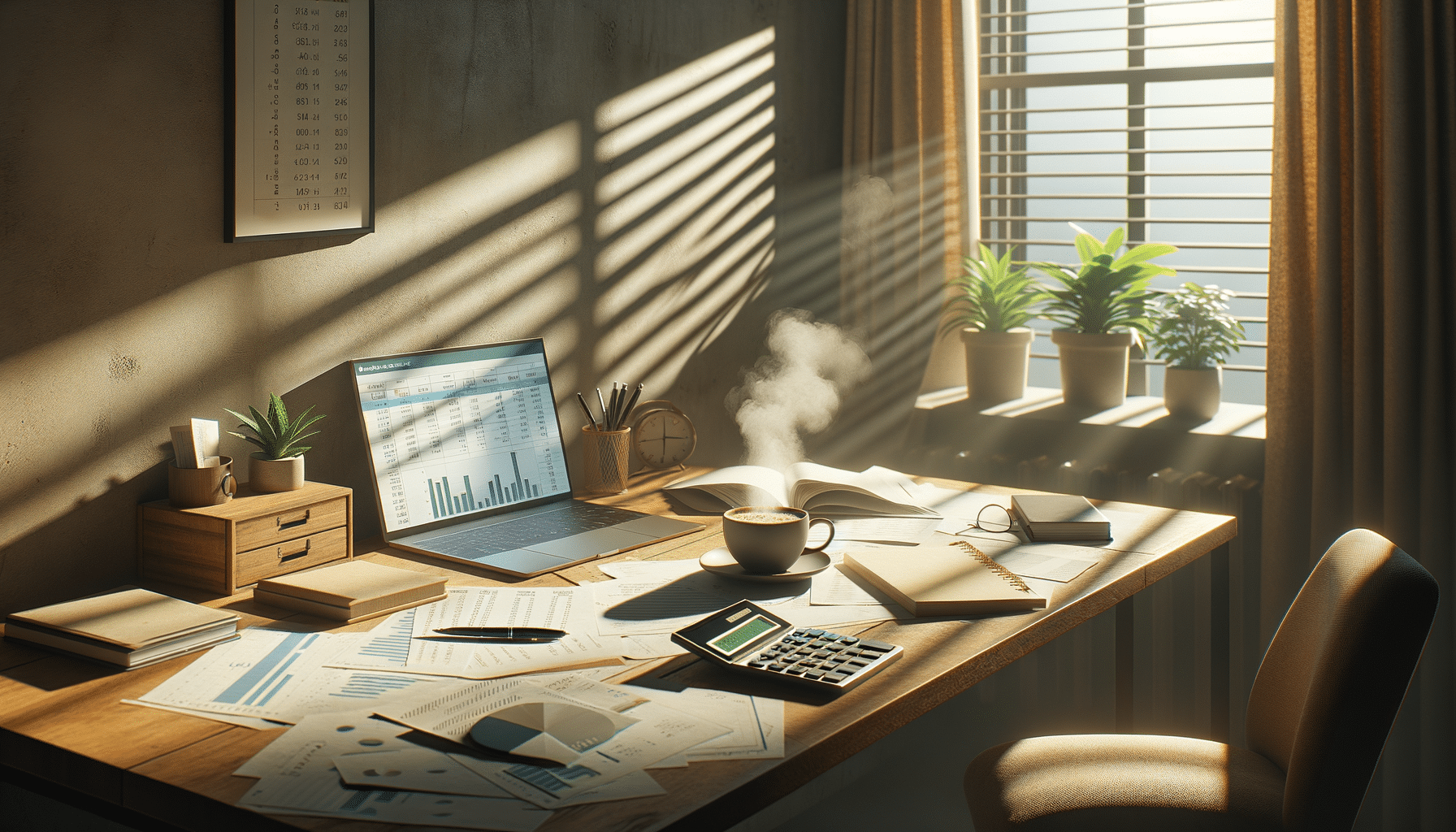

In today’s fast-paced world, personal loans have become a popular financial tool to meet various needs, from consolidating debt to funding a major purchase. However, the decision to take out a loan should not be taken lightly. Understanding your financial situation, comprehending the loan details, and choosing a responsible lender are crucial steps in ensuring that your financial decision is both sound and beneficial.

Assess Your Financial Situation

Before embarking on the journey of obtaining a personal loan, it’s essential to take a step back and assess your current financial situation. This involves a thorough evaluation of your income, expenses, debts, and financial goals. Begin by listing all sources of income and categorize your monthly expenses into fixed and variable costs. This will help you understand your cash flow and identify areas where you might be overspending.

Next, consider your existing debts. Calculate your debt-to-income ratio (DTI) by dividing your total monthly debt payments by your gross monthly income. A lower DTI indicates better financial health and increases your chances of securing a loan with favorable terms. Financial experts often recommend a DTI of 36% or lower.

Assessing your financial situation also involves setting clear financial goals. Are you looking to consolidate high-interest debts, finance a home renovation, or cover unexpected medical expenses? Knowing your objectives will guide you in determining the loan amount and repayment terms that align with your financial capabilities.

Lastly, consider your credit score. A higher credit score can lead to lower interest rates and better loan terms. If your credit score needs improvement, take steps to enhance it before applying for a loan. This might include paying down existing debts, correcting errors on your credit report, or establishing a consistent payment history.

Understand the Loan Details

Once you’ve assessed your financial situation, it’s time to delve into the specifics of the loan you are considering. Understanding the loan details is vital to avoid any unexpected surprises down the line. Start by examining the interest rate. Is it fixed or variable? A fixed rate remains constant throughout the loan term, providing stability in monthly payments, while a variable rate can fluctuate based on market conditions.

Next, consider the loan term. The length of the loan will affect your monthly payments and the total interest paid over time. Shorter terms typically have higher monthly payments but lower overall interest costs, while longer terms offer more manageable payments but accrue more interest.

Fees and charges are another critical aspect to understand. These may include origination fees, prepayment penalties, or late payment fees. Be sure to read the fine print and ask your lender about any fees that may apply. This will help you calculate the true cost of the loan.

Lastly, inquire about the lender’s flexibility in terms of repayment. Can you make extra payments without penalties? Are there options for deferment if you encounter financial difficulties? Understanding these details will provide peace of mind and help you manage your loan effectively.

Choose a Responsible Lender

Choosing the right lender is just as important as selecting the right loan. A responsible lender will provide clear and transparent information, helping you make an informed decision. Start by researching potential lenders, including banks, credit unions, and online lenders. Look for reviews and testimonials from other borrowers to gauge the lender’s reputation.

One of the top options is to choose a lender that offers competitive rates and terms without hidden fees. Transparency is key, so ensure that the lender is upfront about all costs associated with the loan. Additionally, a reputable lender will conduct a thorough assessment of your financial situation to ensure that the loan is suitable for you.

Consider the level of customer service provided by the lender. Are they available to answer your questions and address your concerns? A lender that offers personalized service can make the loan process smoother and more pleasant. It’s also beneficial to choose a lender that provides online account management tools, allowing you to track your loan and payments conveniently.

Ultimately, selecting a responsible lender involves comparing offers from multiple sources and choosing one that aligns with your financial needs and values. Remember, a well-regarded lender will prioritize your financial well-being and help you achieve your goals responsibly.

Conclusion

Taking out a personal loan is a significant financial decision that requires careful consideration. By assessing your financial situation, understanding the loan details, and choosing a responsible lender, you can ensure that the loan supports your financial goals without causing unnecessary stress. Remember to conduct thorough research and seek advice if needed, as informed decisions lead to financial success.